We make your money work for you in an efficient & effective way, so that you can achieve the goal of financial freedom.

Get StartedWe provide adequate & appropriate life, health or property cover, so that you and your family would be able to navigate tough financial times.

Get StartedIts never too early- or late-to plan for retirement; Starting early & appropriate asset mix is the key to retire rich.

Get StartedWe provide a comprehensive financial plan and make sure your kids financial needs are taken care appropriately.

Get StartedWhat is Asset Allocation?

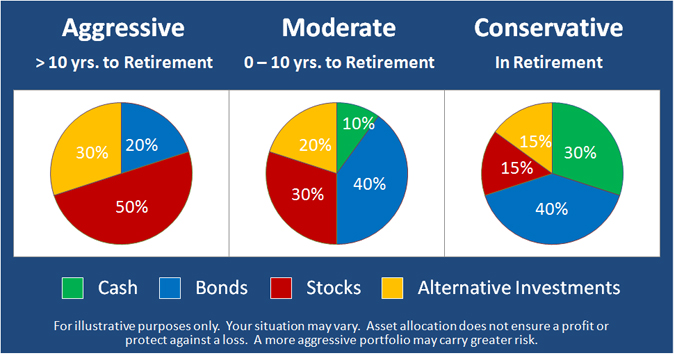

Asset allocation is diversifying your investments in various asset categories like stocks, bonds and gold to minimize risks and optimize returns. The principle of asset allocation draws from the time-tested adage: do not place all your eggs in one basket. By diversifying investments amongst various asset classes, investor can be safe guarded from the volatility in the market. Essentially, asset allocation is based on the premise that different asset classes perform differently in the given market conditions. For instance, stocks provide faster growth and income, but at higher risk, bonds provide stability and lower risk. The importance of diversification also stems from the inability to predict the performance of any asset class for a given time period.

For example purpose only

As with any rewarding venture, the asset allocation process requires some time and effort on the investor's part, given that there is a vast gamut of investment avenues and product offerings to choose from. Before choosing the relevant offerings and building an optimal portfolio, an investor should ask the following questions:

A well-designed portfolio that plies the principles of asset allocation can help investors achieve their investment goals. For example, an investor who is about to retire and will have no source of income post his retirement would do well to opt for a conservative asset allocation and construct a portfolio that emphasizes more on regular income with lower risk i.e. invest more in fixed income avenues (like bonds, assured return schemes and cash) rather than equity.

While an informed investor can create a well designed portfolio for himself, there are products in the mutual funds and insurance segments which offer a new or passive investor the benefit of an inbuilt asset allocation model.

As a result, the investor need not go about determining the asset allocation and selecting various investment avenues. These asset allocation products are targeted at investors who neither have the time nor the required technical know-how to decide on the ideal asset allocation mix..

Also investors must consider taking assistance from a professional financial advisor who can help them with both, determining the right asset allocation and also build a suitable portfolio. Now having discussed the what's and how's of asset allocation, there are a few points which must be remembered before investing.

Points to remember

Rebalancing:

While the importance of asset allocation and constructing a diversified portfolio cannot be overstated, investors must not treat it like a one-time activity. In other words, they should not adopt the "fill it, shut it and forget it" approach. A timely review and rebalancing of the asset allocation mix is required to ensure that the investor stays on course to achieve the ultimate goal.

Taxation:

An investor must be aware of the tax implications while building the portfolio. For instance before selling an investment, the investor should consider the short-term or long-term capital gain tax liability which may impact the overall returns on the portfolio.

Understanding the portfolio:

Notwithstanding the presence of an investment advisor, it is important for the investor to know the specific investment avenues that form a part of his portfolio. An investor should make an effort to understand the portfolio holdings. Each component (investment avenue) is required to play a specific role in the portfolio. Hence, it is vital that investors be unambiguously aware of investments and find out if they are playing their part. This in turn can help investors initiate corrective action, if and when required.

Greed and fear:

An investor must avoid the greed and fear factor i.e. they should not sell or buy an investment in haste or panic. This may lead to them deviating from the investment objective and even result in erosion of capital. Short-term fluctuations should not matter to a long-term investor. Instead, the key should be to focus on the long-haul, while consistently adopting a disciplined investment approach.

In conclusion, asset allocation has an important role to play in helping investors achieve their investment goals. Hence, the need to pay due attention to it while constructing the portfolio.

It is always better to buy stocks and bonds over a period of time, it averages out the cost.

It depends on the instrument you have invested in. Generally there are few clauses in the instruments to restrict investors from early withdrawals. Also there are tax implications if someone withdraws the money and incurs gain on that. It is always better to keep aside a part of your income into contingency funds like liquid funds which can be capitalised in case of emergencies and we don't have to touch the investment for the same.

Out-Living your resources possesses a very high risk during your retirement years, choosing you're a correct asset allocation is critical for a successful retired life. There are many products one can choose from to start receiving immediate income (annuity).

Some of the products that can offer you immediate annuity include bonds, FDs, Post office MIS, tax free bonds, annuity plans from life insurance companies. Factors such as product specific risks, lock-in-period, taxation and liquidity should be considered along with your asset allocation strategy before finalizing a product or a basket of products.

Yes, one can as parent invest in their child's name and starting early also gives you the benefit of compounding. Traditional options such as Public Provident Fund and FDs and the most popular saving tools amongst majority of parents due to assured returns and tax rebate associated with these products. However, given that the cost of education is escalating at a pretty high rate in India, products such as Child Unit linked Insurance that offer cover of education cost in case the parents expire.

These plans are bound to generate higher returns over the traditional plans given their market participation. The risk associated with these plans is similar to that of mutual funds schemes. Lately the central government has also introduced schemes to save for girl child offering 1% higher rate than that of 10 year government security. While, investing it is always recommended to invest in a combination of products.

Several financial instruments are available in the Indian money market. These are government securities, or G-sec, preference shares, commercial papers, equity shares, certificate of deposits, call money market and industrial securities.

Government Securities: In India, mainly the institutional investors buy the government securities. Both the Central Governments and the State Governments issue them. Commercial banks are the biggest investors who buy the G-secs.

Preference Shares: These carry a fixed dividend rate and a special right to dividends over the private equity holders. Currently, all the preference shares in the Indian market are redeemable, that is, they have a fixed period of maturity.

Commercial Papers (CP): These are issued mainly by the corporate businessmen to fund their working capital needs. Commercial Papers are issued generally for short-term maturities.

Equity Shares: It is a "high return risk" instrument. Equity shares don't have any fixed return rate and thereby, no period of maturity.

Certificate of Deposits (CD): These are very similar to the Commercial papers. But the CDs are issued mainly by the commercial banks.

Call Money Market: The loans made in the call money market are mainly short term in nature. Call money market mainly deals with the interbank markets.

Industrial Securities: Normally the big corporate bodies are used to issue this to fulfil their long-term requirements regarding working capital. The debentures and equity shares fall under this category.

Pan Card is mandatory for investing. Adhaar card can be submitted as an additional proof.

Yes

SIP: or systematic investment plan is a mode of investment, wherein the investor makes periodic investment (monthly, quarterly, yearly) in the particular investment instrument. The major benefits of SIP are to average down our investment (Rupee cost averaging) to reduce the volatility in the portfolio. Also salaried individuals can opt this option to invest from their monthly salary.

ELSS: equity linked saving schemes as the names suggested is one of the type of mutual funds scheme. These funds offer tax benefits under Sec 80C of income tax, according to which investment up to Rs. 1.50 lakhs is deductable from taxable income

FMP: Fixed maturity plan are type of debt fund where the investment portfolio is closely aligned to the maturity of the scheme. FMPs are somewhat different than a fixed deposit in a bank. FMPs are debt schemes, where the corpus is invested in fixed-income securities

If the applicant is below 18 years of age then Guardians signature is required otherwise not.

Investing is a long-term process and one should not expect immediate returns for the product. The typical investment horizon for an investment in equity and equity linked products ranges from a minimum of 3 to 5 years.

There are many reasons why you should stay invested for a longer time such as erratic market movements during shorter periods which can lead to equity markets giving negative returns, long business cycles, government and regulatory changes, global and local events, micro and macro events and to benefit of power of compounding etc. If you have an investment horizon below this then you should park your money in to safer asset classes such as debt schemes from mutual funds and Bank FDs